Job Costing: The Definitive Guide for Your Business

One common method for allocating overhead is the use of predetermined overhead rates. These rates are calculated at the beginning of the accounting period based on estimated overhead costs and an allocation base, such as direct labor hours or machine hours. For instance, if a company estimates its total overhead costs to be $100,000 and expects to use 10,000 direct labor hours, the predetermined overhead rate would be $10 per labor hour. This rate is then applied to the actual labor hours worked on each job to allocate the overhead costs. This method provides a consistent and straightforward way to distribute overhead, though it relies on accurate estimates and may require adjustments if actual costs deviate significantly from projections. Allocating overhead costs is a nuanced process that requires careful consideration to ensure accuracy and fairness in job costing.

Job Cost Sheet FAQs

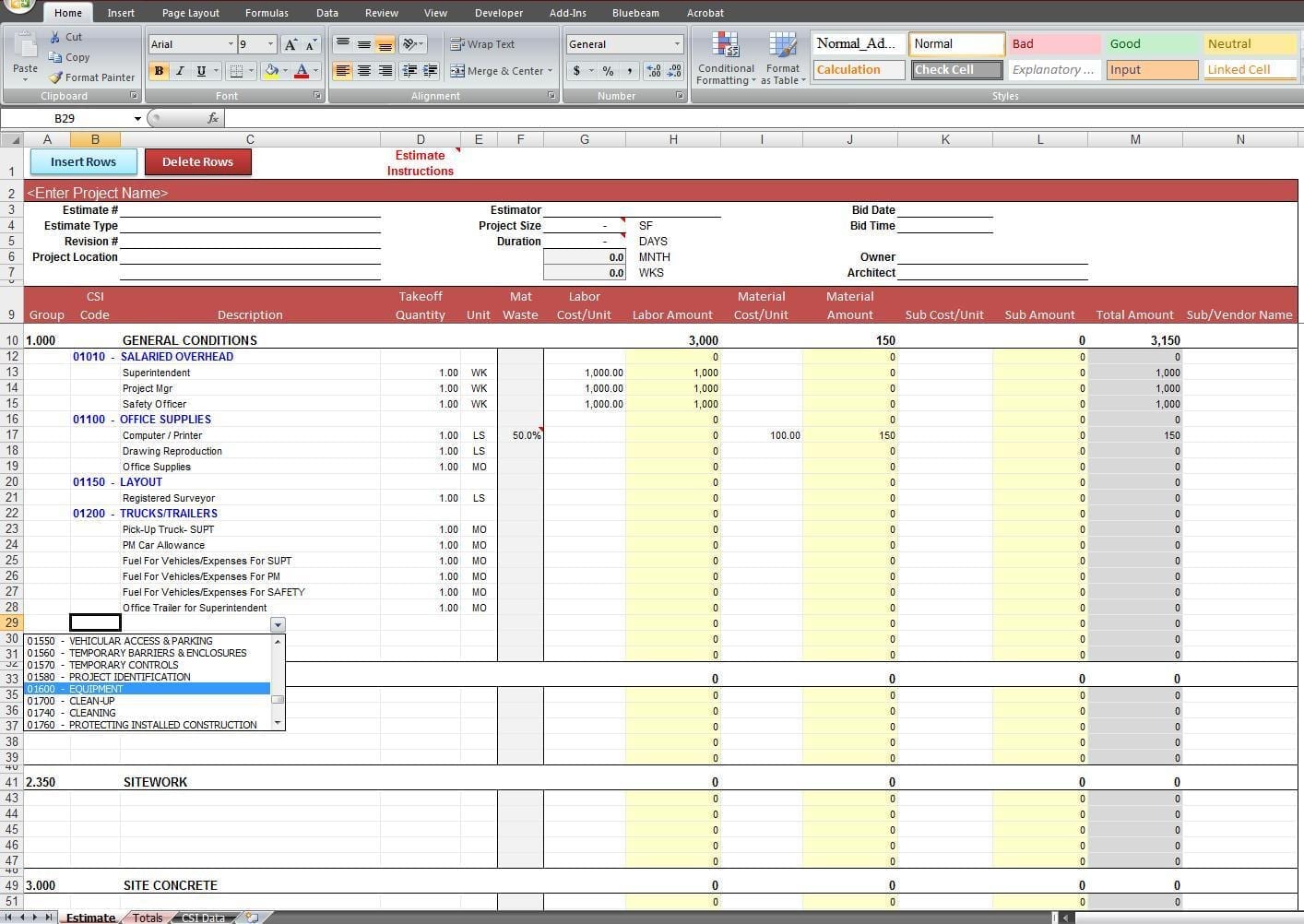

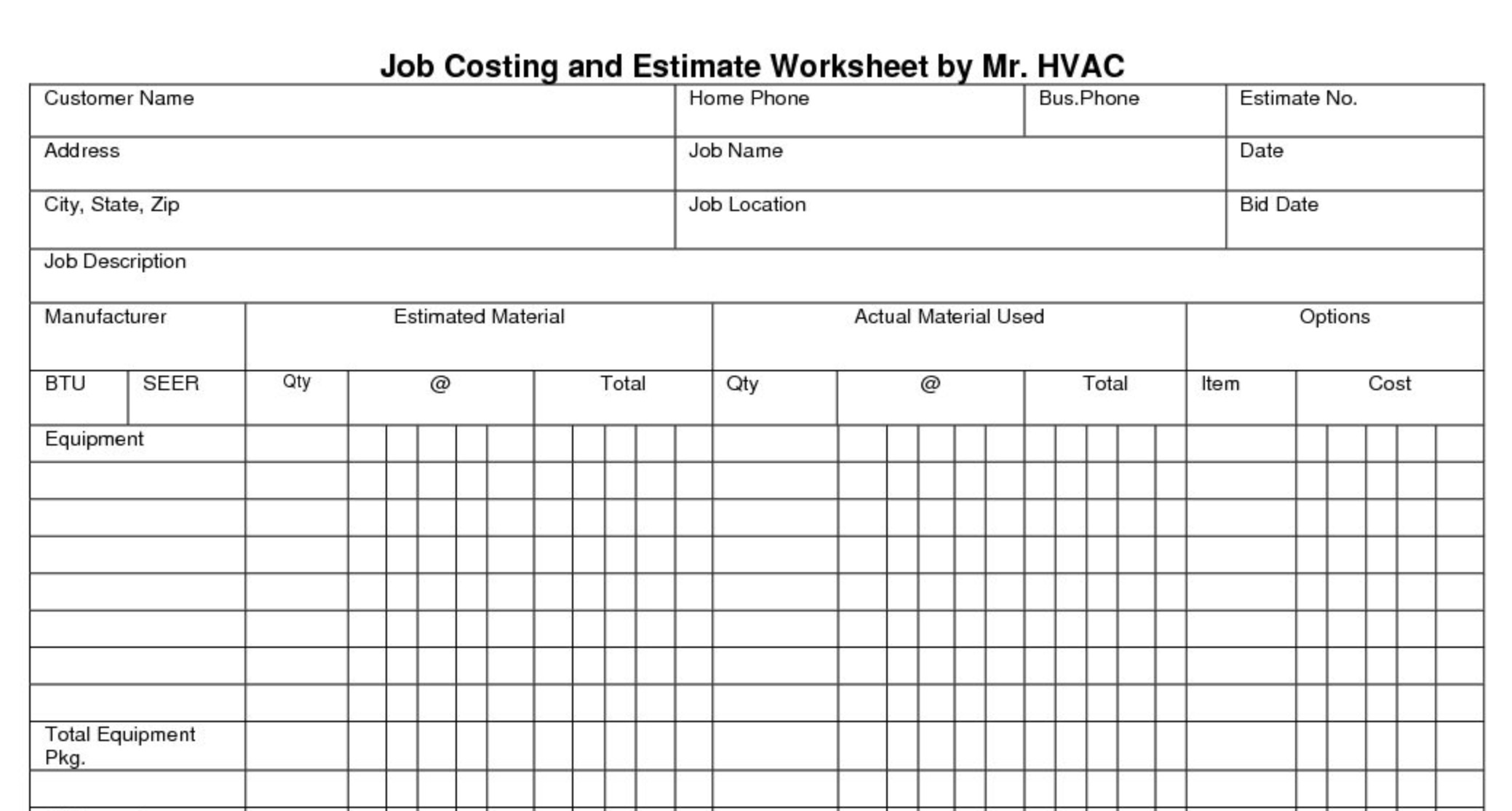

Enter category and items, projected and actual costs, responsible parties, status, and percentage of each task complete. The template also doubles as a budgeting template by keeping tabs on amounts currently paid and due, so you can see your projected and actual project total and track outstanding payments. Depending upon the format of the job cost sheet, it may accumulated depreciation definition also include subtotals of costs for direct materials, direct labor, and allocated overhead. The sheet also computes the final profit or loss on the job by subtracting all of the compiled costs from a total of all billings to the customer. One of the primary benefits of job costing is its ability to help construction firms manage and adhere to project budgets.

Metrics Tracked in the Report

Record description of fault and works carried out, provide other details such as completion of risk assessment, car park, expenses, etc., and capture photo evidence. Without the right software, this can make it very difficult to keep track of labor costs. Job costing is important because it gives businesses an idea of how much they will be spending when completing a product or service.

FAQs on Job Cost Sheet

It helps identify which projects you should focus on and where you might be wasting money and effort. This part of the sheet aggregates the detailed costs into a total job cost, providing a quick snapshot of the overall financial impact. It often includes subtotals for each cost category, making it easier to compare and analyze different jobs. A job cost sheet is a comprehensive document that captures all the financial details related to a specific job or project. At its core, it includes several key components that collectively provide a clear picture of the costs incurred.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- Companies will often spread these costs across projects using a systematic formula.

- Under job costing, production is undertaken by a manufacturer against a customer’s order and not for stock.

For small businesses with limited resources, the insights gained from job cost sheets are particularly crucial. These sheets allow small business owners to precisely allocate costs, understand the efficiency of their workforce, and optimize the use of materials and resources. The ability to compare actual costs against budgeted amounts ensures that small businesses can stay within financial constraints and make informed decisions for future projects. Use this simple project costing template to determine the total funds, including direct and indirect costs, required to complete your project. The template allows you to compare best case, most likely, and worst case scenarios, so you can refine your cost estimates for each task. A comprehensive breakdown of labor, material, and overhead costs using a job costing software helps businesses set prices effectively and measure profitability.

Is there any other context you can provide?

To record all the direct and indirect costs incurred in the completion of each job, the costing department should prepare a job cost card or job cost sheet. In process costing, the cost is determined by the process and the number of products that are produced. The cost calculation for process costing is based on the process, not the job, as in job costing. A job cost sheet is a document that shows the total cost of a job and its components. Where job costing is used to track the specialised, short-run production of a job, process costing is used to track the cost of mass-produced identical units. A job cost sheet is also a useful tool for businesses that make job bids.

And with all of the moving parts of job costing, it can be time-consuming and confusing to perform the work on your own. Payroll and accounting software can be used to generate labour costs and expenses for you, so you don’t have to spend time crunching the numbers. Job costing, also known as project-based accounting, is an accounting method used for tracking the cost and profitability of individual projects or “jobs” within a business. Technicians using the Field Promax mobile app can complete time tickets in real-time, resulting in a live activity base in the system that can be quite useful to the management team. Besides, Field Promax offers a comprehensive dashboard that gives you access to job details, material costs, and labor hours in one spot for maximum convenience.

This could be based on the proportion of direct labor hours, direct costs, or machine hours each project consumes. It adds the labor, materials and overhead for each job to make sure that production costs are correct. As in construction, this allows the company to measure profitability and hit targets for margin. It also allows them to benchmark themselves against the competition to uncover areas that can be improved and make them more competitive. Using job costing in manufacturing also helps plan budgets and operating expenses over the long term. Moreover, job cost sheets support small businesses in building a foundation for continuous improvement.

To simplify and streamline the calculation process, you can use a job costing software. It’s important to remember that if subcontractors are hired for specialized tasks beyond your company’s expertise, their costs should be included. This ensures that your labor cost calculations are accurate and comprehensive.

Direct costs are those directly attributable to the production of the job, such as materials, labor, and subcontractor expenses. Indirect costs, on the other hand, are the overhead expenses that cannot be directly attributed to a specific job, such as utilities, rent, or general administrative expenses. A project costing template is a structured form that project managers use to calculate the total funds required for a project. Use the template to estimate your project’s total projected expenditures and to ensure that you account for all direct and indirect costs. Designed for IT departments, this project costing template helps IT project managers accurately estimate project costs. The Project Budget section allows you to list the final figures for contingency, as well as the fixed, material, contractor, and total project costs.

It can be difficult to determine the exact cost of all inputs for individual activities. But anyone who has been running a plumbing business for some time knows that more elements go into the process. Namely, you need to provide your customers with an estimate for the job and pay for the labor and parts to be used in the job. The job cost sheet is most commonly developed using an electronic spreadsheet, based on a standard template that includes a number of standard items, so that the cost accountant is reminded to include them.